Payment routing

OpenPay offers a variety of flexible payment routing options you can leverage to boost acceptance rates, reduce fees, and optimize your global payment stack.

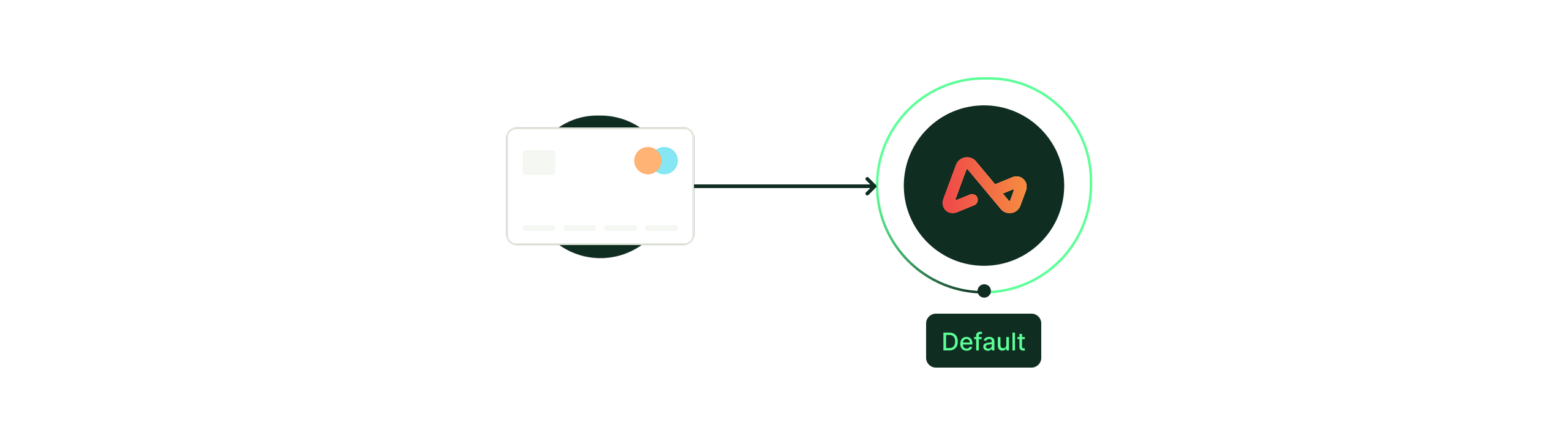

Default only

Always routes payments to a single, designated primary processor. Simple to set up, but doesn’t adapt to failures or performance changes.

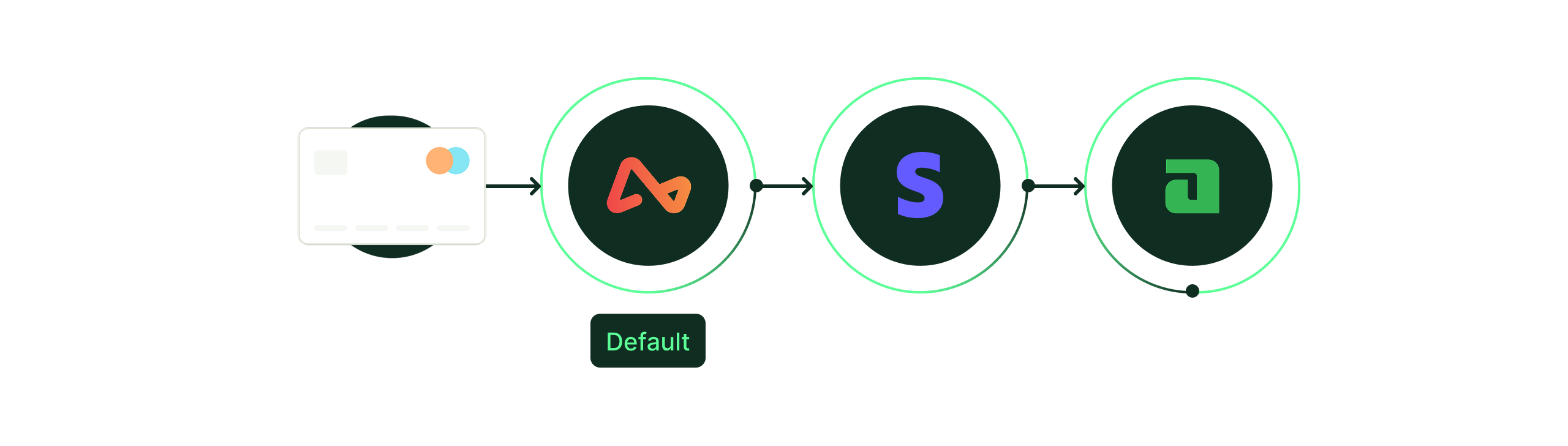

Default with recency fallback

Attempts the default processor first, but falls back to the most recently added processor if the initial attempt fails—helpful in dynamic or inconsistent payment environments.

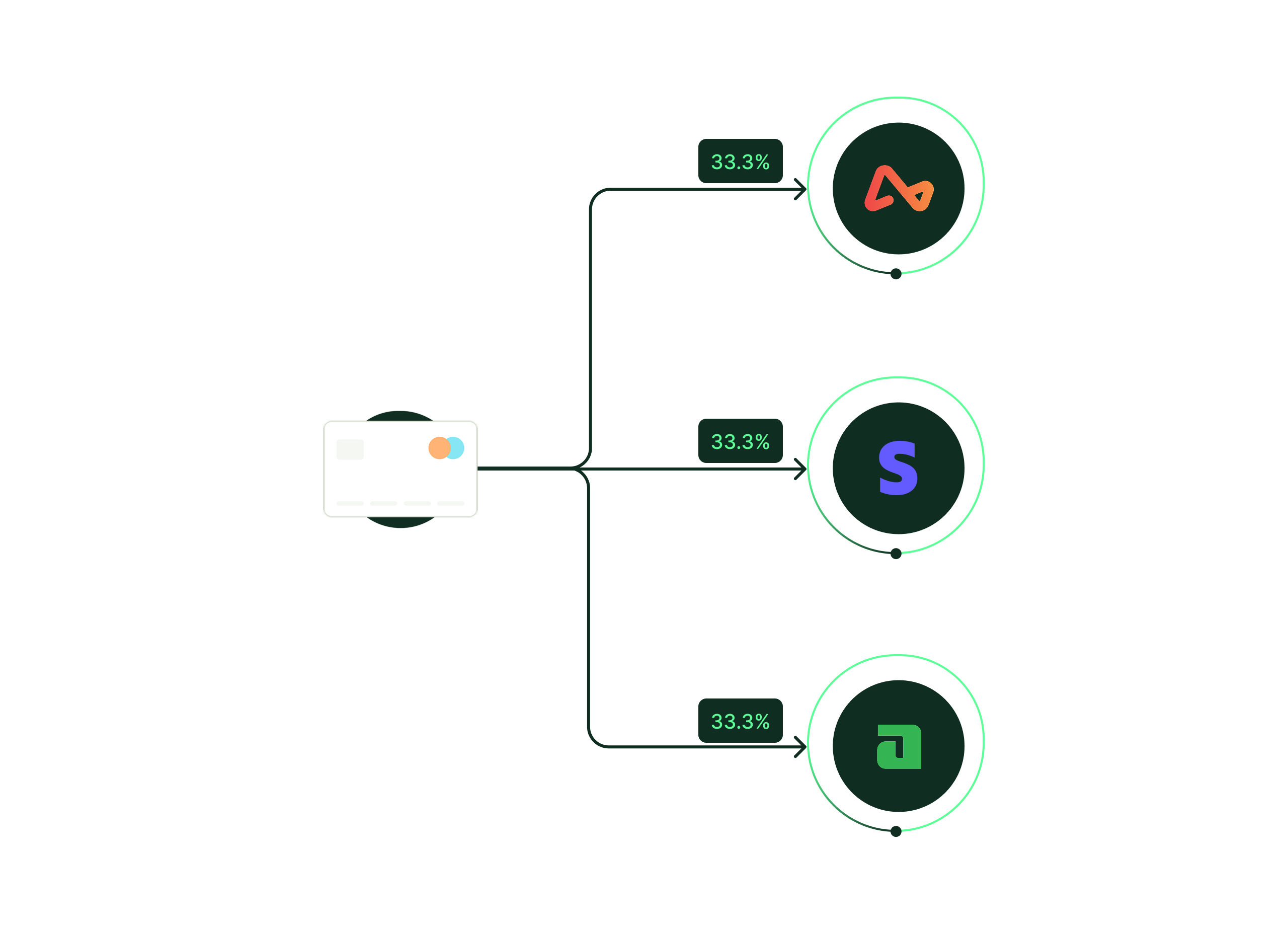

Random uniform

Distributes payment attempts evenly across all available processors. Useful for load balancing or testing processor performance without bias.

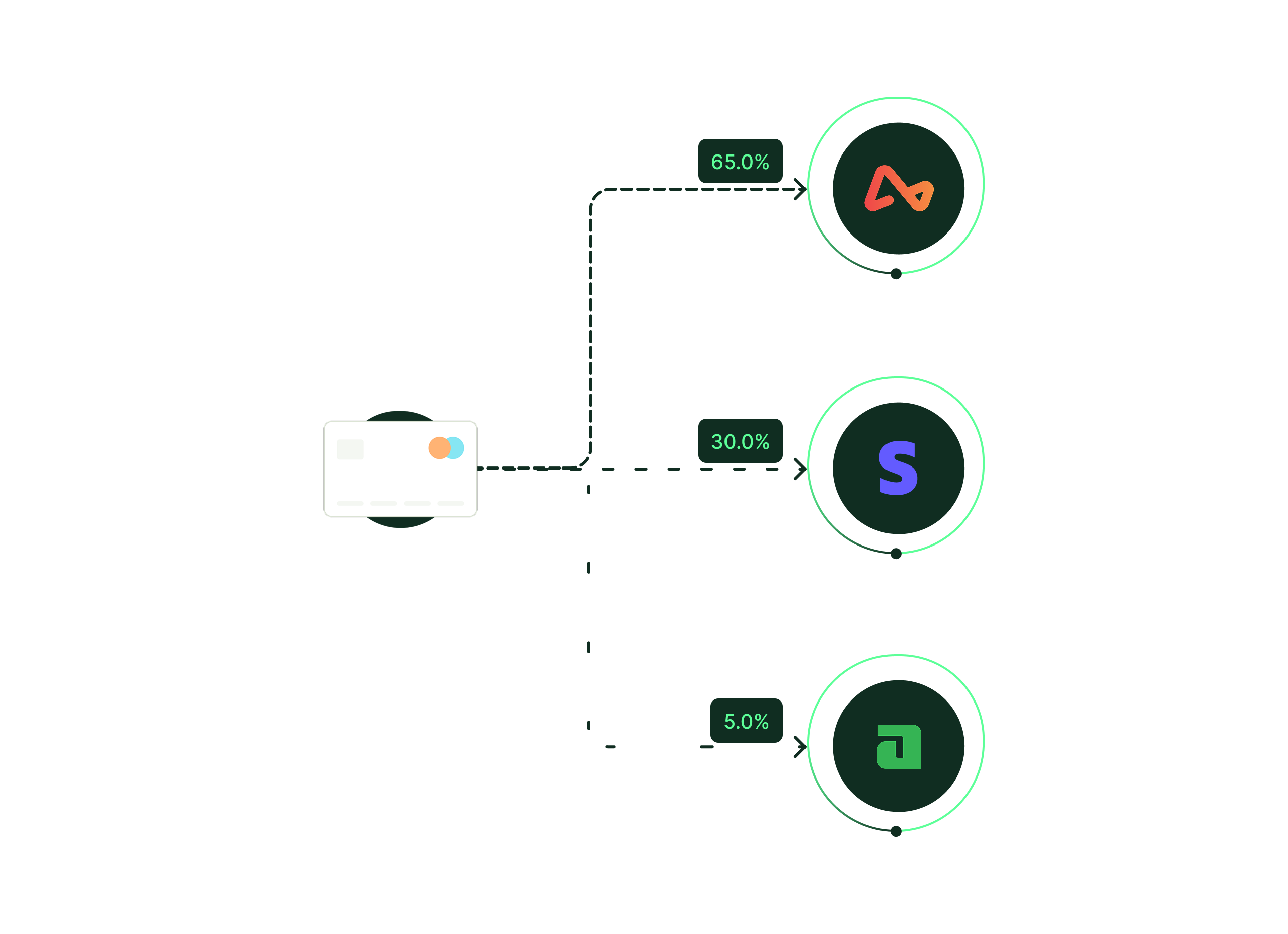

Random weighted

Routes payments based on pre-configured weights per processor (e.g., 65% to Processor A, 30% to Processor B, 5% to Processor C). This allows controlled testing or prioritization of preferred processors.

Custom

Custom Routing gives you full control over how payments are directed across your connected processors. This lets you optimize for cost, approval rates, regional coverage, and compliance requirements — all without changing your checkout flow.

You can define routing logic based on several parameters:

1. Payment Method

Route transactions according to the payment method selected by the customer (e.g., card, ACH, wallet, BNPL, etc.).

Use this to:

-

Send cards to one processor and bank transfers to another.

-

Route alternative payment methods (APMs) to region-specific providers.

2. CIT vs MIT

Differentiate between Customer-Initiated Transactions (CIT) and Merchant-Initiated Transactions (MIT).

This distinction is critical for recurring billing and card-on-file payments.

Use this to:

-

Route initial authorizations (CITs) through one provider.

-

Route recurring charges (MITs) through a lower-cost or higher-approval processor.

3. Card Setup Phase

Checkout can be configured in two distinct phases:

-

Setup Phase – Used to tokenize or pre-authorize cards with a specific processor.

-

Charging Phase – Used to capture or charge those same cards with a different processor.

This separation allows you to benefit from the strengths of multiple processors — for example, setting up cards in a provider with strong 3DS support, while routing live charges through one optimized for better acceptance or lower fees.

4. Card Type

Route transactions based on whether the card is credit or debit.

Use this to:

-

Send debit cards to processors with strong bank network connectivity.

-

Route credit cards to providers offering lower interchange or better risk handling.

5. Card Country

Automatically route transactions according to the card’s issuing country.

Use this to:

-

Localize processing for higher approval rates (e.g., route EU cards to an EU acquirer).

-

Ensure regional compliance (e.g., domestic routing requirements).

-

Manage currency and cross-border costs effectively.