Payment service providers

OpenPay integrates with top payment processors and gateways, each offering a distinct combination of features, global coverage, and multi-currency support, delivering a seamless, secure, and global payment processing experience.

Who does OpenPay integrate with?Copied!

StripeEnable Stripe as one of your payment service providers in OpenPay.

AirwallexEnable Airwallex as one of your payment service providers in OpenPay.

Authorize.netEnable Authorize.net as one of your payment service providers in OpenPay.

AdyenEnable Adyen as one of your payment service providers in OpenPay.

PockytEnable Pockyt as one of your payment service providers in OpenPay.

LoopEnable Loop as one of your payment service providers in OpenPay.

Checkout.comEnable Checkout.com as one of your payment service providers in OpenPay.

CybersourceEnable Cybersource as one of your payment service providers in OpenPay.

PayPalEnable PayPal as one of your payment service providers in OpenPay.

NMIEnable NMI as one of your payment service providers in OpenPay.

What is a payment processor?Copied!

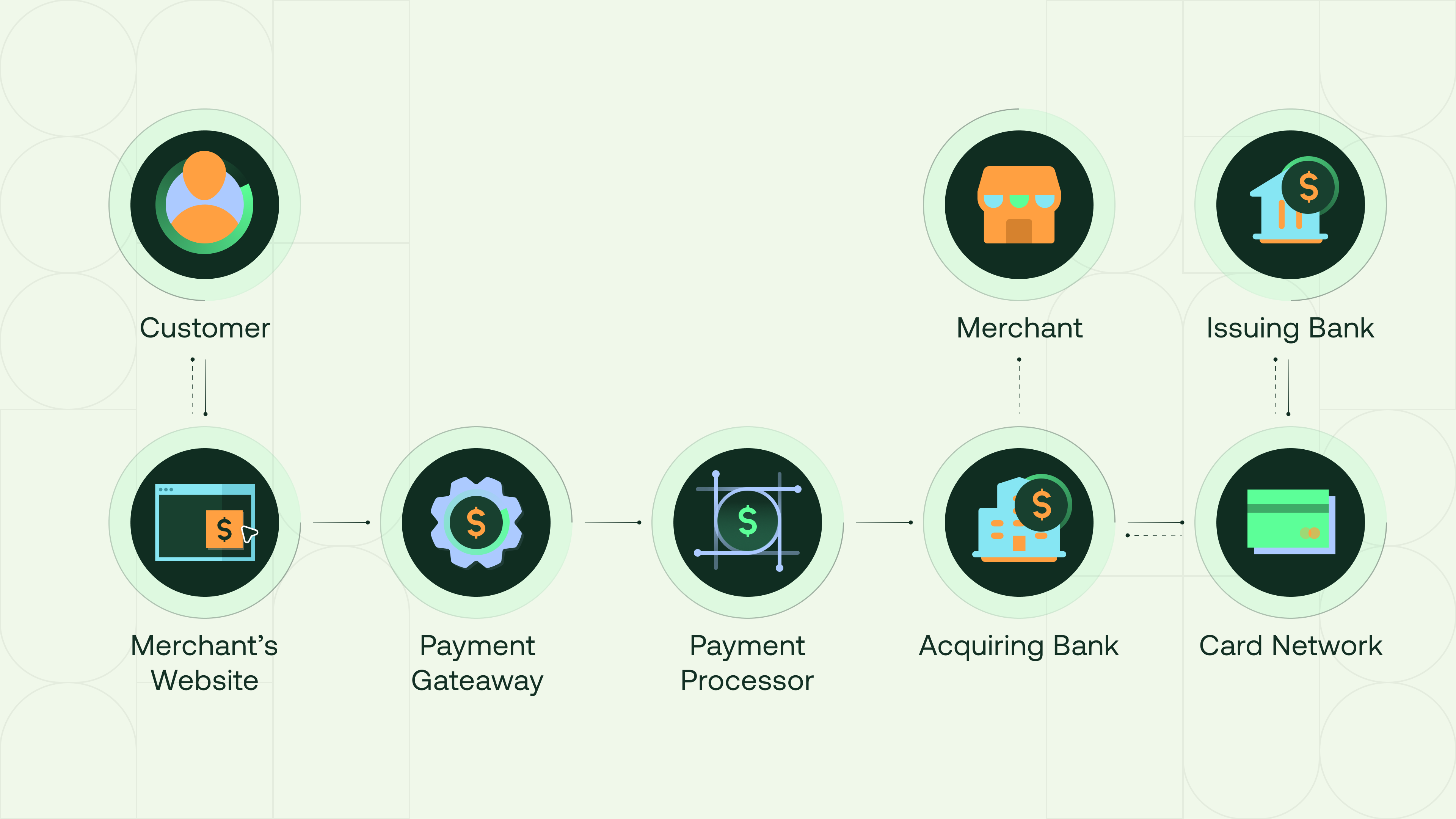

A payment processor is responsible for handling the communication between the merchant, customer, and banks to ensure payments are securely and successfully completed. They provide the infrastructure that makes digital and card payments possible for businesses.

Key functionsCopied!

-

Authorization: The payment processor verifies the customer's payment details (such as credit card or bank account) and checks if the funds are available for the transaction.

-

Transaction Routing: It routes the payment information to the appropriate bank or financial institution (often called the "acquiring bank") for approval, and communicates with the "issuing bank" (the bank that issued the customer’s card) to approve or deny the payment.

-

Settlement: After the payment is authorized, the payment processor helps ensure the funds are transferred from the customer’s account to the merchant's account.

-

Security: The payment processor ensures that payment information is securely transmitted, often by using encryption and fraud prevention measures to protect sensitive data (such as credit card numbers).

What is a payment gateway?Copied!

A payment gateway facilitates the communication between the merchant’s website or point-of-sale system and the payment processor. It is responsible for transmitting payment details securely between the customer, merchant, and processor.

Key functionsCopied!

-

Secure Data Transmission: The primary function of a gateway is to securely capture and transmit sensitive payment data between the merchant’s site and the payment processor. This is typically done through encryption protocols.

-

Authorization Request: The gateway sends the payment details to the processor, which then communicates with the issuing bank for authorization.

-

Integration: A payment gateway provides an API (or integration tools) that merchants can use to accept payments on their website, mobile app, or in-store systems.

-

Fraud Prevention: Some gateways include fraud detection tools to flag potentially fraudulent transactions (e.g., through CVV verification, 3D Secure, etc.).

Key differencesCopied!

|

Feature |

Payment Processor |

Payment Gateway |

|---|---|---|

|

Main function |

Manages the authorization, settlement, and transfer of funds between banks. |

Transmits payment data securely from merchant to processor for authorization. |

|

Scope of service |

Focused on processing payments (authorization, settlement, etc.). |

Focused on securely transmitting payment data to and from the processor. |

|

Examples |

Stripe, Airwallex, Adyen |

Stripe, Authorize.net, PayPal |

|

Involvement in transactions |

Only processes the financial transaction (authorizes and settles funds). |

Secures and transmits transaction data, but doesn’t handle funds directly. |

How they work togetherCopied!

A payment gateway captures and securely transmits payment information from the customer to the Payment Processor. A payment processor communicates with the customer’s bank or credit card network to authorize the transaction and settle the payment.

In many cases, modern payment processors (like Stripe or PayPal) combine both roles—they act as both the gateway and the processor, offering an integrated solution for merchants. However, in other cases, businesses may use a separate payment gateway (like Authorize.net) in combination with a payment processor (like Worldpay).